If you only want term life insurance to cover your outstanding mortgage, then you may not want to pay for a policy which provides a level lump sum as well. Similarly, certain professions (such as soldiers) are not covered by many ‘standard terms’ policies. Smokers, for instance, are likely to attract higher premiums than non-smokers, and people with certain pre-existing medical conditions may find it hard to get covered. The insurer will use these factors to judge how likely it is that a claim will be made during the term of your policy. your lifestyle, including whether you are a smoker.To get a term life insurance policy, a number of factors will have to be considered to assess your situation and level of risk. What does a term life insurance quote consider? If you find yourself in this position, then buying life insurance may become a serious consideration. It is quite possible that you discover that your loved ones ability to finance life as they know it would change dramatically without your income, even if you are well-off. Check your employer’s death-in-service policy to see how much it would leave your loved ones with, as well as factoring in any savings, investments and saleable assets you may have.Ĭompare that to your financial obligations, such as mortgage repayments, day-to-day living expenses and contracts. Try to be as thorough as possible as even things like insuring, taxing, servicing and running a car can potentially cost thousands of pounds. The amount of money you leave loved ones will have a significant impact on their lives, and may help when making decisions on important life choices, such as whether they will be able to stay in the same school or continue to live in the house they are used to.Ĭonsider the amount of money you are likely to leave and compare it to the ongoing cost of living that will continue after you’ve gone. It’s always a good idea to take stock of your financial situation, even if there is no particular cause to do so. If you're unsure about which types of death are covered under your policy, check your policy agreement or contact your insurance provider.If you’ve found yourself thinking about buying life insurance, then in all likelihood you have started to assess what financial situation you would leave your loved ones in should you no longer be around. The type of death is not covered under your policy Your beneficiaries are unable to provide the necessary documentation to make a claim You provided inaccurate information when applying for cover (for example by deliberately withholding medical information) There are a handful of reasons for this such as: In some cases, your insurance provider can deny a claim made against your policy. They will also ask for documents such as your death certificate and policy document. This can usually be done in person or online via your provider's website. Once contacted, our insurance provider will ask your selected beneficiary to fill out a claims form. There's no time limit on filing a claim for a life insurance policy, so you can focus on more important issues during this difficult time. Once you have passed away, your family must notify your insurer, either by calling them on their contact number or online. Second death pays out after both policyholders have died. The surviving member receives a payout which they can use to cover the household's finances. Term Life Insurance covers you for a specific length of time (the term) and pays a lump sum if you die during that term. First death pays out after one of the policyholder dies.

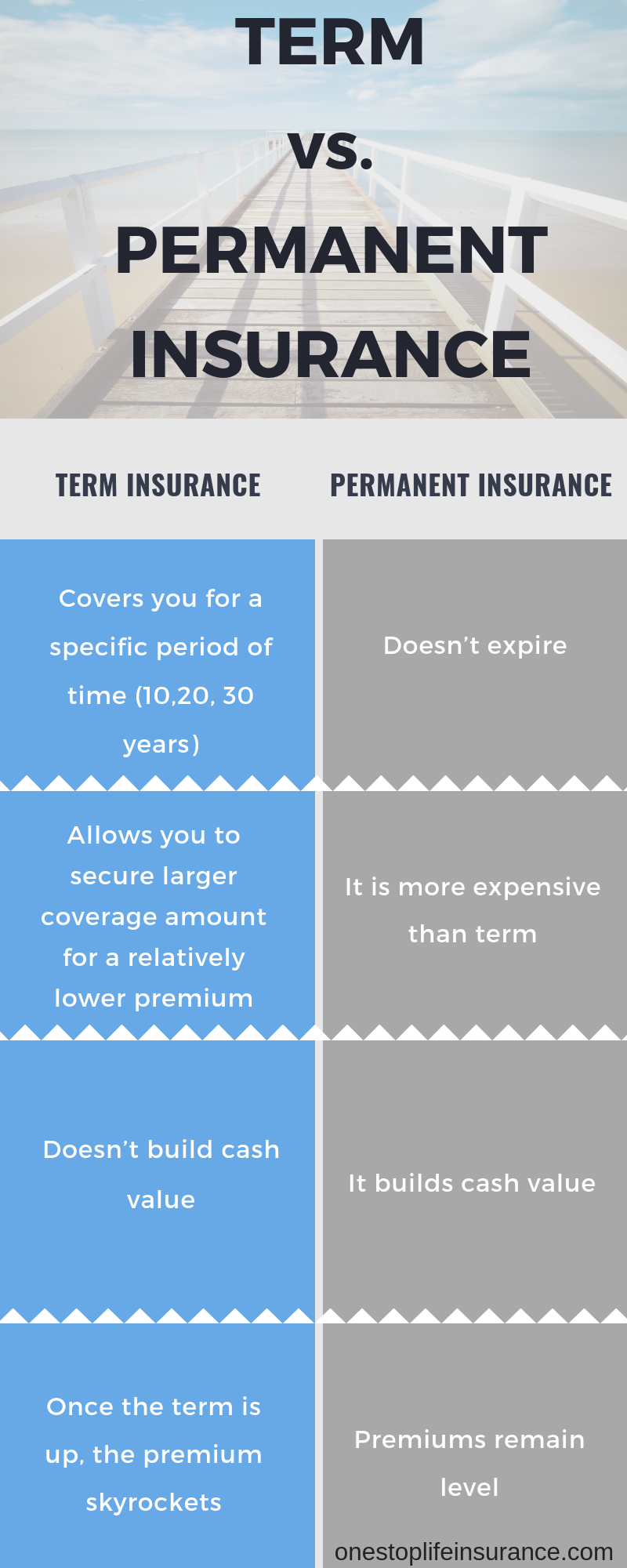

Joint life insurance has two types of cover - first death and second death. It's popularity with couples is due to the fact it can be easier to manage and work out cheaper than buying separate policies. A joint policy provides financial protection for two people within a single policy. If you and your partner share equal responsibility of your household's income, you should consider getting a joint life insurance policy. If you’re struggling to decide between term life insurance and whole life insurance, check out this helpful article - Whole And Term Life Insurance: Which Is Better? Joint life insurance One of the main differences between the two is that whole life policies typically occur a higher monthly payment for premiums, than term policies. Term life insurance works differently from whole life insurance - which provides cover for the remainder of your life, as opposed to a specific policy term. Both the value of the payout and cost of your premium payments remain the same throughout the policy. Whole life policies pay out regardless of when you die, issuing a lump sum payment to your loved ones. Rather than covering you for a certain period of time, like term insurance, whole life insurance covers you for the rest of your life. Alternative types of life insurance cover Whole life insurance

0 kommentar(er)

0 kommentar(er)